You Need Legacy Ensuring Business Exit Planning

If your company is one of your most valuable assets and you want to plan what happens when you step away and ensure the highest possible resale value...

You Need A Properly Structured IUL

If you desire expert guidance on Indexed Universal Life (IUL) insurance to help you build wealth and secure your future...

You Need Funding For Your Business

If you're struggling with cash flow or missing out on growth opportunities due to limited capital. Business funding offers quick access to the resources needed to stabilize operations, invest in expansion, and take advantage of time-sensitive opportunities...

You Prefer No In-Person Office Visits

If you enjoy a seamless, fully online process with no in-person meetings...

You Appreciate Annual Reviews

If you'd like to stay on track with complimentary yearly assessments to ensure your money vehicle continues to perform as expected...

You Value Top-Tier Customer Service

If you expect unmatched support with dedicated professionals ready to assist you at every step...

You Want To Attend Financial Literacy Workshops

If you seek to gain valuable financial knowledge through expert-led sessions designed to empower you with smart money strategies...

Our Promise To You

For all Life Strategist customers, our team will present to you and assist with implementing a legitimate, bonafide, and verifiable strategy to save you at least 25% - 100% toward your current, previous, or next year’s taxes or your money back. GUARANTEED!

STILL NOT SURE?

Frequently Asked Questions

General

What are your core values?

At ShieldWolf Strongholds we have 7 core values are We're Persistent, We Take Action, We're Committed to Education, We're Discreet, We're Intuitive, We're Sincere, and We have a Healthy Lifestyle.

Can you save me money on my taxes?

Yes. We can save business owners, and high income executives and employees 25% - 100% on your current federal and state income taxes or your money back. GUARANTEED!

Do you offer a money back guarantee?

For all Life Strategist customers, our team will present to you and assist with implementing a legitimate, bonafide, and verifiable strategy to save you at least 25 - 100% toward your current, previous, or next year's taxes or your money back. GUARANTEED!

How long is your money back guarantee good for?

Our money back guarantee is good for up to 12 months. This should give you more than enough time to confirm that we were able to deliver on our promise.

Appointments

How can I speak to a Life Strategist?

You can schedule a consultation using the following link: https://shieldwolfstrong.com/appointment. Our consultations are done virtually or by phone and are available on Tuesdays, Wednesdays, Saturdays from 11AM ET - 8:30PM ET. **All appointments are in U.S. Eastern Timezone.

How long are the initial consultations?

Both phone and virtual consultations are 30 minutes.

Business Exit Planning

What are the 5 D's of succession planning?

The 5 Ds of succession planning are Death, Disability, Divorce, Disagreement, and Distress, representing common life-altering events that can disrupt a business, necessitating proactive planning for continuity, leadership transition, and asset protection to ensure the company's survival and smooth operation despite unexpected challenges.

What is the most common mistake in succession planning?

The most common estate and succession planning mistake is failing to plan at all. It's an easy topic to avoid, after all, who wants to think about death or disability? But failing to plan limits your options and leaves your family without guidance.

Other common mistakes include:

Planning only for succession emergencies. ...

Failing to secure buy-in on your succession plan from senior stakeholders and the board. ...

Neglecting your HiPo pool. ...

Deploying one-size-fits-all development programs for successors. ...

Not having a set timeline or clear criteria for success.

Where do I start with succession planning?

Key aspects to have in a business succession plan:

Identify priority roles.

Define what is needed for each role.

Find possible succession candidates for each role.

Discuss career aspirations with your candidates.

Set an action plan for developing future candidates.

Estimate when transitions may occur.

How long does it take to create a succession plan?

Every company's timeline is individual. But it often takes 12 months or more to build out a leadership succession plan and depending on business needs it could take more than two or even three years. That's why often, by the time the business owner feels ready, he or she may already have fallen behind.

Employee Benefits

What type of employee benefits do you provide?

Individual/Family Health (Under age 65)

Short Term Health

Dental/Vision

Prescription Drug/Part D/PDP Only

Life

Annuity

Long-Term Care

Group Medical

Group Ancillary

Worksite

Disability

Life Insurance

What type of life insurance policies do you offer?

Term Life

Whole Life

Index Universal Life

What’s the minimum that I need to start an Index Universal Life (IUL) policy for retirement income?

The rule of thumb is to take whatever your current age is, then multiply it by 10. That final number is typically the minimum that you need to pay monthly into an IUL.

For Example:

If you’re currently 40 years of age.

40 x 10 = 400

This means the minimum that you need to start and fund the IUL is $400 per month ($4800 annually)

Who is the best company to go with for life insurance?

It depends on your needs and/or the type of insurance product. ShieldWolf Strongholds works with several trusted partners to help find the best solution for your particular situation.

What death is not covered by life insurance?

Life insurance typically doesn't cover deaths from suicide within the first couple of years, fraud or misrepresentation on the application, illegal activities, or certain high-risk hobbies, and often excludes death from war, terrorism, or overdose (especially within the contestability period), with specific exclusions depending on the policy, like hazardous activities or military service.

Is it cheaper to go through an insurance broker?

Insurance brokers aren't always cheaper; they can sometimes add fees or commissions, but they often save you money long-term by finding better value, accessing exclusive deals, and matching complex needs (like high-risk profiles) with specialized insurers, potentially offering significant savings that outweigh their costs, especially for complicated coverage. Your final cost depends on comparing their fees and potential savings against going direct, but their expertise can lead to better overall value.

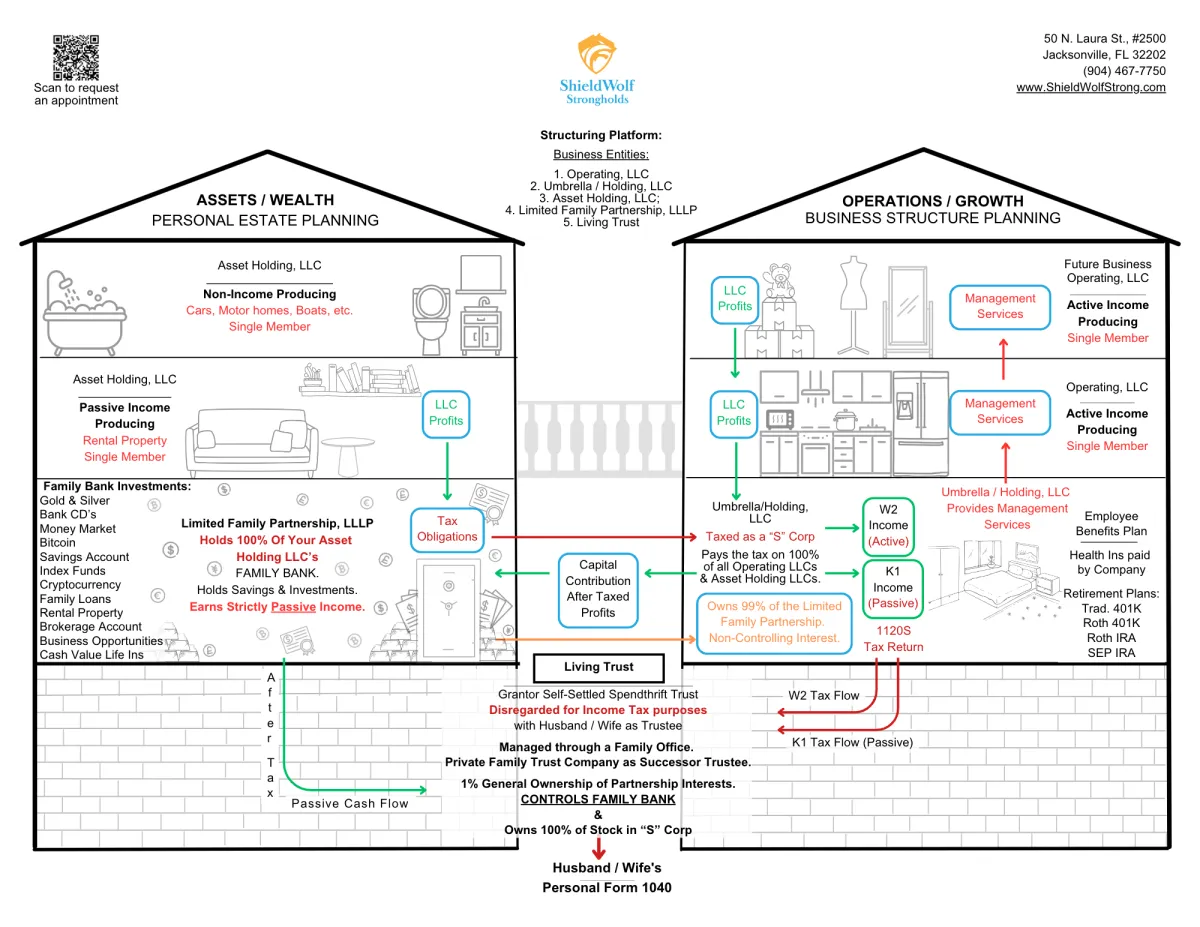

Estate Planning

Aren't estate plans only for ultra rich people?

No, estate plans are not just for the wealthy. They are crucial for anyone with assets (home, savings, car), minor children, or specific wishes for end-of-life care, as they prevent court-mandated asset distribution, minimize probate fees, and appoint guardians. Without a plan, the state determines who receives your property, which can create significant legal hurdles and conflict for families.

How much is an estate plan?

We offer multiple packages to fit individual needs. You can view our pricing and list of included services here: ShieldWolfStrong.com/pricing. Alternatively, if you're unsure which option will fit your needs best, you can schedule a free consultation here: ShieldWolfStrong.com/appointment.

What documents are needed to assist in funding my trust?

Property Deed or any Document with the Legal Description of Property.

Secured Realty Notes (such as Contract for Deed)

Promissory Notes due to you

Accounts at the bank (checking, savings, money markets, CDs, upload only the cover page)

Registered Securities (mutual funds, managed accounts. Upload the entire statement with all pages)

Stocks/Bonds on a public exchange (typically paper bonds with a name on them)

Annuities with death benefits

Life Insurance

IRA (traditional &/or Roth)

Retirement plans (401k, 403B, Deferred Comp, TSP)

Motor Vehicles (only if paid for)

Business EIN Document(s) *

Business Articles of Organization areDocument(s) *

Business Operating Agreement(s) *

Business Partnership Agreement(s) *

Business Shareholder Agreement(s) *

*If you are a business owner